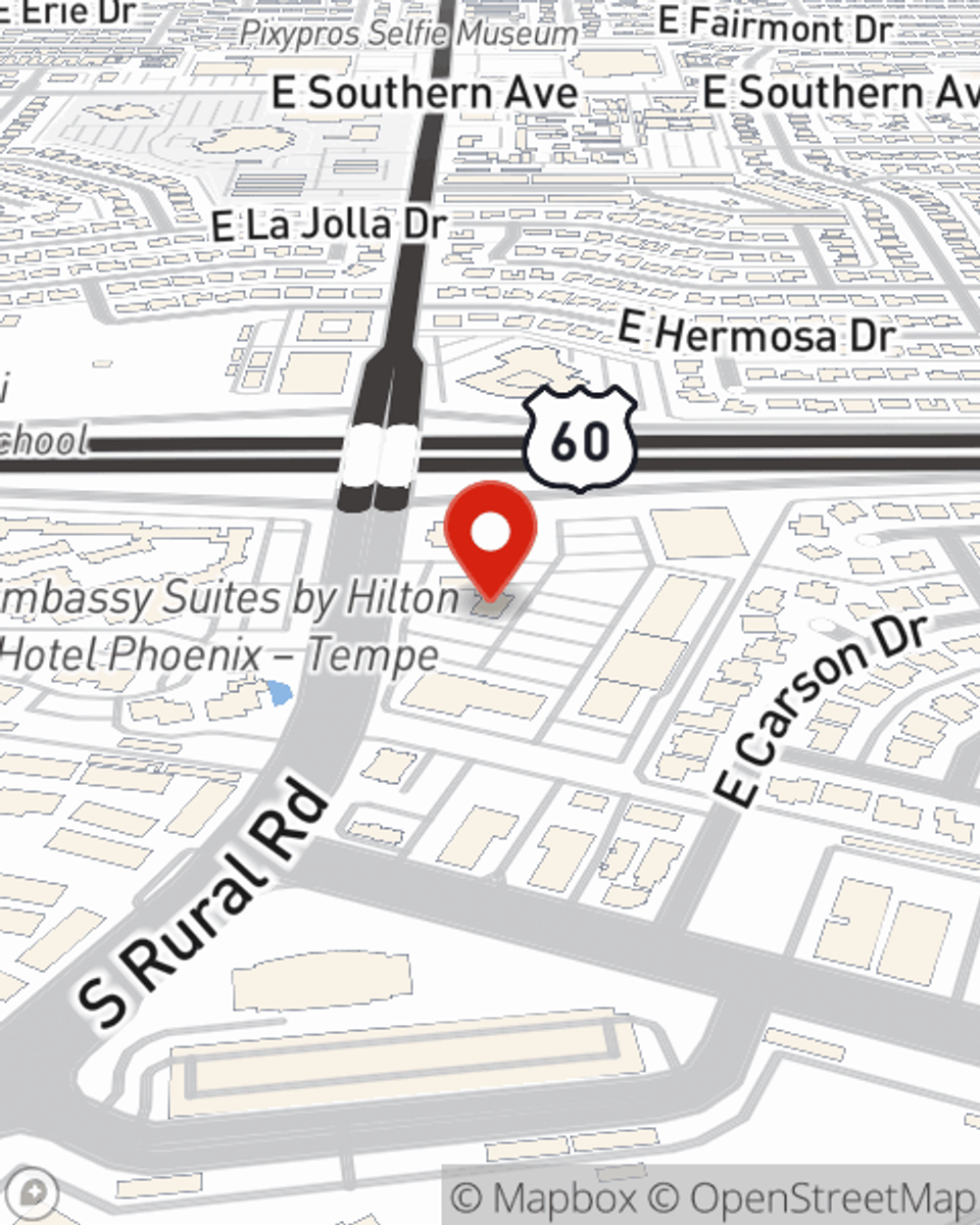

Business Insurance in and around Tempe

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Help Prepare Your Business For The Unexpected.

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Sharon Layman help you learn about quality business insurance.

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Keep Your Business Secure

If you're looking for a business policy that can help cover business property, equipment breakdown, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

Contact the wonderful team at agent Sharon Layman's office to discover the options that may be right for you and your small business.

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Sharon Layman

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.